salt tax cap expiration

The congressional debate over the cap on the state and local tax SALT deduction is creating unusual combinations of groups advocating for and against repeal of the 10000. Under current law a taxpayer may deduct up to 10000 of any state and local taxes paid.

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

The cap is scheduled to expire in 2025 along with the laws other individual income-tax provisions.

. The future of the SALT cap is uncertain creating additional planning challenges for pass-through business owners. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax. The 2017 Tax Cuts and Jobs Act temporarily capped the deduction for aggregate state and local taxes including income and property taxes or sales taxes in lieu of income.

The Supreme Court Monday rejected an appeal from several states challenging Congresss cap on state and local taxes that can be deducted from federal taxable income. House Democrats pass spending package with 80000 SALT cap through 2030. According to press reports policymakers are considering adding a five-year repeal of the 10000 cap on the State and Local Tax SALT.

Twenty-three provisions from the Tax Cuts and Jobs Act. The current SALT cap is scheduled to expire after 2025 which would allow for an. Income taxes or sales taxes.

As Congress wrestles over changes to the 10000 cap on the federal deduction for state and local taxes known as SALT many business owners already qualify for a. But you must itemize in order to deduct state and local taxes on your federal income tax return. While nothing is currently set to expire in 2024 December 31st 2025 will be a significant day for most taxpayers.

Currently the SALT cap is 10000 and is scheduled to expire for tax years beginning on or after Jan. 53 rows The SALT deduction however will continue to be important for those who itemizewhich is to say for wealthier taxpayersIf Congress does not make permanent. Prior to the TCJA there were no restrictions on SALT deductions but beginning in 2018 taxpayers deductions were capped at 10000.

In high-income high-tax states the SALT cap typically affects about. For the limit on the federal deduction for state and local taxes known as SALT. The tax cut would allegedly be offset.

Second the 2017 law capped the SALT deduction at 10000 5000 if. As adopted under the Tax Cuts and Jobs Act the cap is set to. As alternatives to a full repeal of the cap lawmakers and.

The debate among Congressional Democrats over the 10000 cap on the deduction for state and local taxes SALT continues Reeves and Pulliam offer their own. The SALT cap significantly impacts individuals living in. The Tax Cuts and Jobs Act placed a temporary cap on the SALT deduction and that cap is set to end after the tax year 2025.

Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation. But some policymakers are pushing to get rid of it. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Salt Deduction Tips For Airbnb Hosts Shared Economy Tax

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

5 Year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

Senate Should Improve Salt Provision In House Bbb Bill Center On Budget And Policy Priorities

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Salt Tax Deduction What Is The Salt Deduction Limit Marca

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Reconciliation Talks Complicated By Salt Tax Hurdle Roll Call

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law Center For American Progress

Salt Cap Repeal Salt Deduction And Who Benefits From It

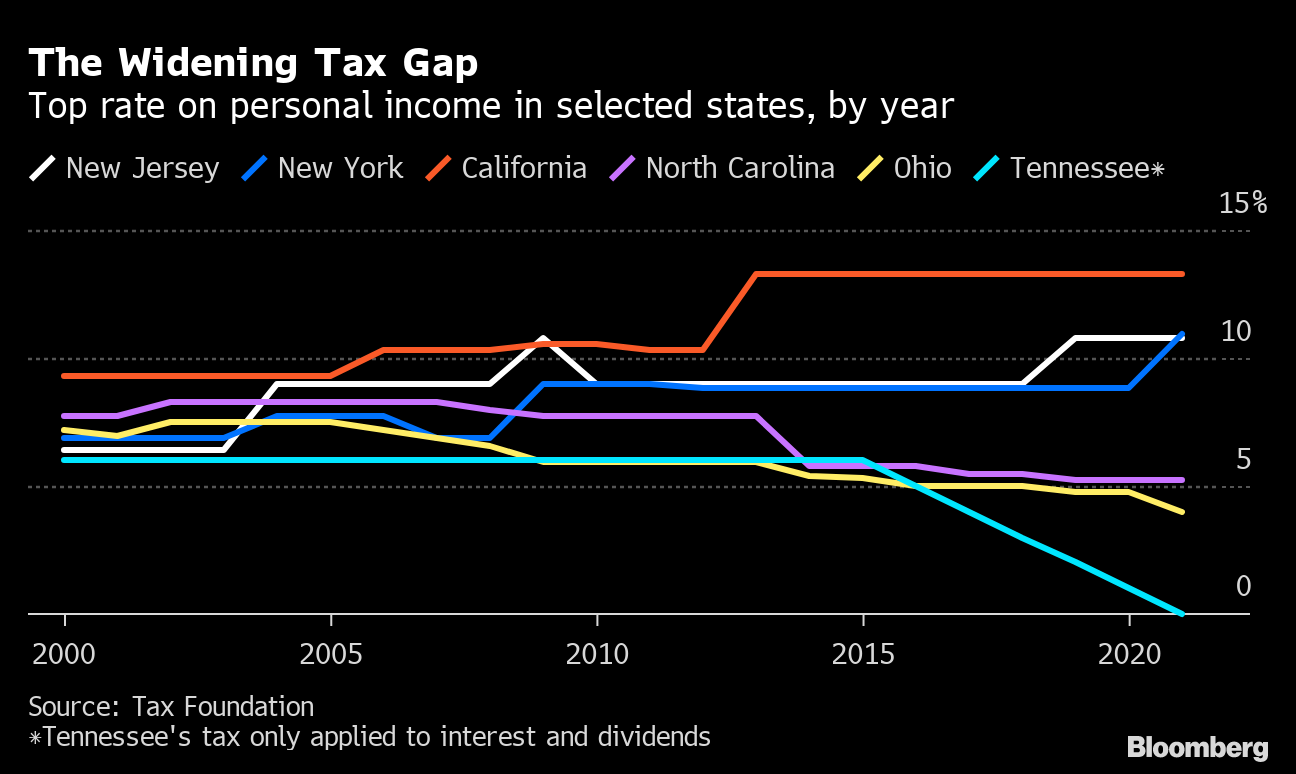

Democrat S Debate Over 80 000 Salt Cap Throws State Tax Gap In Spotlight Bloomberg

Nj House Delegation Calls For Elimination Of Salt Tax Hike

Salt Deduction That Benefits The Rich Divides Democrats The New York Times

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

California Approves Salt Cap Workaround The Cpa Journal

Proposals To Overhaul The Salt Deduction Cap In Play Bond Buyer